Stop Illinois Internet Tax Bill

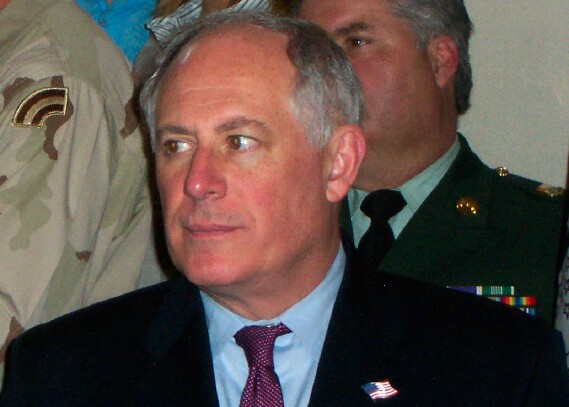

Illinois Governor Pat Quinn

If you live in Illinois, contact Governor Quinn immediately and tell him not to sign the new Illinois Internet Tax Bill HB 3659, aka the Amazon Tax. The Internet Tax Bill was passed by the Illinois Senate on January 5 and by the House of Representatives on January 6 and is now awaiting Governor Quinn's signature. This bill will force online businesses with affiliates in Illinois to pay taxes on every sale originating from those affiliates. According to John Cullerton's (Democrat and Senate President) web site, this new law would give Illinois an additional $150 million in revenues and that it will "spur economic activity and job growth".

Unfortunately the reality is that the Illinois Internet Tax Bill may well result in a revenue loss for the state, a loss of income to Illinois citizens and business, and an increase in unemployment!

Point 1: In the four states that have passed similar laws (New York, Colorado, North Carolina and Rhode Island), instead of the state collecting additional revenue, the online merchants instead severed their relationships with affiliates in that state. The result was no new sales tax income for the state.

Point 2: When in-state affiliates are dropped, they no longer receive commission income on the associated sales – which means that they report less business income to the state – which means that not only do state revenues from income tax decline, but that those business' now have less money to spend.

Point 3: Twelve other states have looked at the issues associated with similar proposed legislation in their states and wisely decided to reject the legislation.

Point 4: For affiliate businesses with employees, the business may move out of state to avoid being dropped – meaning a loss of jobs for state residents, a loss of income to local suppliers to that business, and a further loss of tax revenues to the state. At least one company located in Illinois – FatWallet.com – has stated that it will relocate to Wisconsin in order to save its business.

Unfortunately my state representative Paul Froehlich (56th district, Democrat) voted yes on this bill but fortunately Froehlich did not seek reelection and will be out of office once the newly elected representatives take their seats. Sadly my state senator John Millner (28th district, Republican) voted for this bill as well so I will be contacting him to express my displeasure with his action.

Tell Governor Quinn To Say NO To The Illinois Internet Tax Bill

If you are a citizen of Illinois, please contact Governor Quinn and tell him not to sign the Illinois Internet Tax Bill HB 3659, aka the Amazon Tax. Thank You.

Illinois Budget Background

Illinois is in dire budgetary straits. Illinois politicians are desperate as they have grossly mismanaged the state budget. Even though the state constitution calls for a balanced budget, Illinois is looking at a state budget deficit that is expected to hit $15 Billion by this summer. In addition, Illinois is ranked as the worst state in the nation when it comes to funding its pension funds. Currently Illinois' unfunded pension liability is approaching $100 Billion! As a consequence, bond rating agencies continue to downgrade Illinois municipal bond rating – now down to an A-. This results in increased interest costs to the state as it borrows money to pay its bills.

Unfortunately for me, my property tax bill increased a whopping 30 percent from 2009 to 2010. In an act of cowardice, our incumbent politicians made sure that delivery of the second installment of the property tax bills was delayed until after the election in order to avoid voter backlash. Note that here in Cook County we had the highest sales tax in the nation in 2010! There was a slight cut back in the sales tax rate in advance of the election so I am unsure as to whether or not we still have that honor. Now the politicians in Springfield are proposing a 75 percent increase in state income tax!. Amazing since Illinois did not even have a state income tax until 1969. And now we have the creation of the new Internet tax! Frankly, given the manner in which our elected officials have thoroughly mismanaged the state budget, I don't think that I would trust to give them another dime. In terms of spending, Illinois is now spending 30% more per person in inflation adjusted dollars than it did just 10 years ago!! This is obviously a trend that must be stopped.

Disclaimer: I am an Amazon affiliate so this legislation does affect me personally, although the financial impact is nil.

| Return to the Blog Index | This entry was posted on Sunday, January 9th, 2011 at 1:55 pmand is filed under Odds and Ends.

One Response to “Stop Illinois Internet Tax Bill”

-

The way our State budgets have been corrupted is not going to end with tactics designed to increase mismanagement of taxes and adding the Internet is just as evil as stealing money from the Teachers' Pension Funds. Cease and desist these nefarious activities.